Retailers Use Broadcast Ads to Promote Higher-Priced Hardware 11/11/2015

It is no secret that the shopper’s path to purchase has changed, and changed permanently. Those changes are particularly evident with younger demographics, but even the most stubborn of older shoppers have picked up new ways to better inform their purchase decisions. Today, consumers have access to more information sources to learn about a product, read about other shoppers’ experiences with the product, and find the best deal on the product than they did 15, 10, or even five years ago.

Retailers have had to adjust their methods for attracting shoppers in turn. Today’s more advanced retailers not only whether or not they are meeting shoppers at every point of influence in their purchase process, but also what type of message they are delivering at those points of influence.

Market Track, a provider of advertising, promotional, and pricing intelligence, has observed an evolution in how retailers leverage different advertising media. Traditionally, TV commercials advertised a brand message to heighten consumer awareness of the brand. Many TV advertisements still deliver that brand message, yet more and more advertisers are using their TV spots to feature limited time promotional offers designed to prompt a purchase of a specific product in the near term, especially those products that solve a consumer problem.

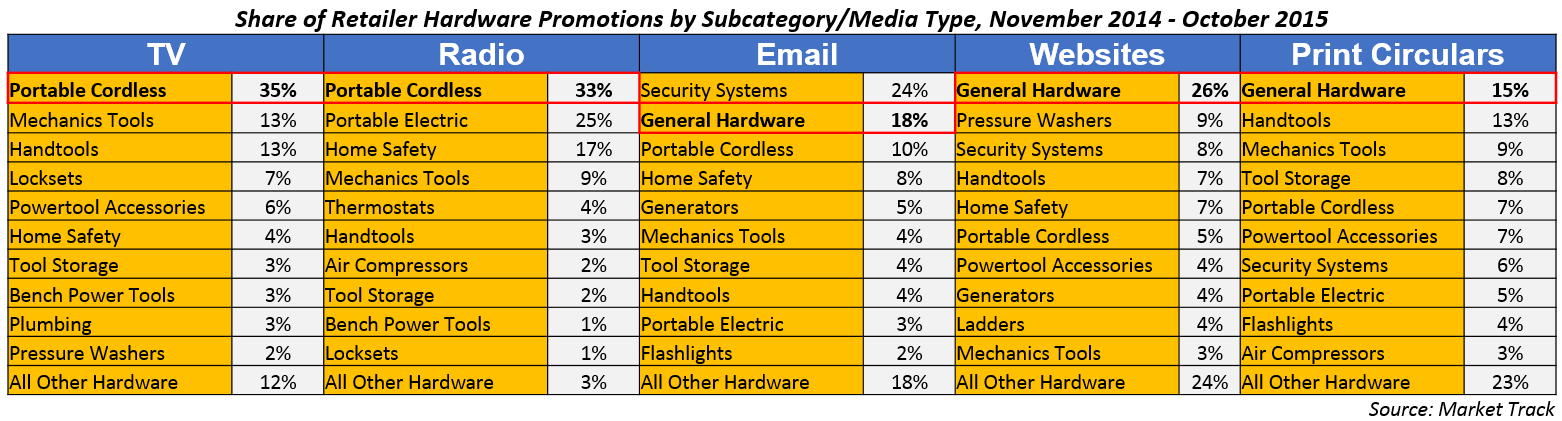

In the figure below, Market Track reviewed the omni-channel promotional activity for the Hardware category between November 2014 and October 2015, and found that retailers advertised over 120,000 Hardware product promotions in TV and radio commercials during the 12 month period (all markets, all ad occurrences). Additionally, they found retailers tend to promote different Hardware products in broadcast ads than they do in more traditional promotional channels such as print circulars, their websites, or in their email blasts.

Over one-third of the Hardware promotions advertised in TV and radio ads were for Portable Cordless Tools (such as the Ryobi set depicted below). Comparatively, Portable Cordless Tools made up only 10% of Hardware promotions in email, 7% in print circulars, and only 5% on retailer websites.

In traditional media, retailers tended to feature lower-priced Hardware categories. General Hardware—including work gloves, safety glasses, and hearing protectors, among other manual work accessories—was the top promoted Hardware category on retailer websites and in print circulars in the last year, and ranked second in promotional emails. Part of this disparity in category allocation is likely attributable to available space. Retailers can feature more Hardware categories in print circulars and on their website than they can in a 15-second TV ad.

However, price plays a large factor in influencing shopper perception of whether a retailer offers good value, or is generally the more expensive option. The promotion over lower-priced categories in their print circulars keeps shopper perception of their overall prices in line, while the promotion of premium Cordless Tools in their TV commercials tells shoppers that the retailer stocks quality products.

Retailer advertising is falling more and more in line with today’s path to purchase. The Hardware category provides one example of the new path to purchase has impacted advertising and promotional strategy.

Ryne Misso is the Director of Marketing at Market Track, a global provider of advertising and promotional tracking, brand protection, and eCommerce pricing solutions. Over 1,200 clients leverage Market Track’s competitive insight into print, digital, broadcast and eCommerce to optimize their advertising strategy. Prior to transitioning to Marketing, Misso spent four years in account management for Market Track’s small and mid-market manufacturer vertical.