Industry Trends: 2017 Home Health Care 10/19/2016

Fast Facts:

- Home Care began in the US as early as the 1880s. *NACH.org

- Patients average three or more impairments with daily living activities, 4.2 medical diagnoses each

- Over 3.3 million Medicare beneficiaries receive home health services

- Over 400,000 licensed or registered nurses, aids, and other practitioners provide care *HarrisWilliams

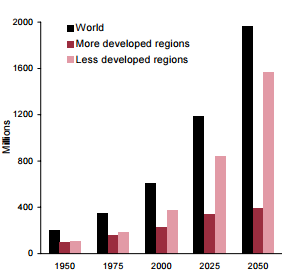

- The number of older persons has tripled over the last 50 years; it will more than triple again over the next 50 years Population Aged 60 and Over 1950-2050. *UN.org See Figure 1 for a breakdown by year

Key Numbers:

- 12,400: number of HHC agencies (2014 cdc.gov)

- 80%: Proportion of agencies with for-profit ownership (2014 cdc.gov)

- 70% of home health patients are senior citizens

- 89% of seniors prefer care at home

- 88.5 million: population projection by 2050 *IFA

- 5 billion: Miles driven by HHC workers *NAHC.org

- 5 million: Number of patients who received and ended care any time during the year CDC.gov 2013

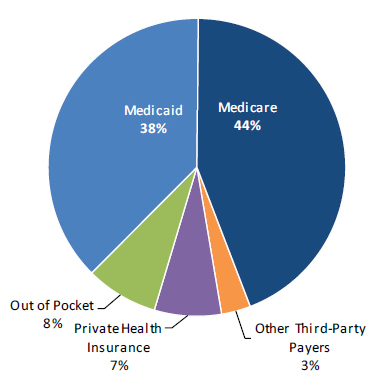

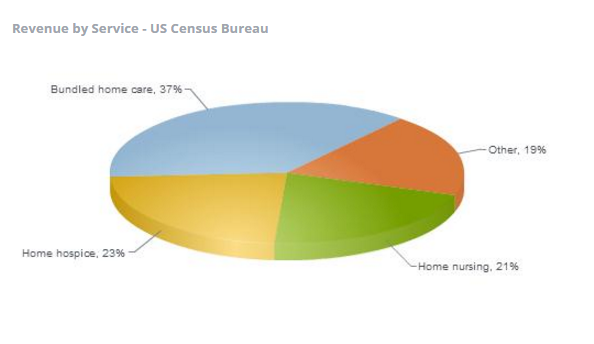

- See Figure 2 for a breakdown of home health care spending which amounts to $78 billion.

Overview:

- Companies in the HHC industry provide a range of skilled nursing, health care, and personal care services to patients in their homes.

- Major companies include AMEDYSIS, Apria Healthcare Group, Gentiva Health Services, and Lincare Holdings (all based in the US), Allied Healthcare (UK), LVL Médical Groupe (France), and Revera (Canada).

- Although patients are the users of home health care services, marketing is focused on those who authorize or pay for treatments, including doctors, hospitals, insurers, and managed care companies. *Hoovers

- Total home health care spending: $78 billion *Hoovers 2016

Industry Forecast & Growth:

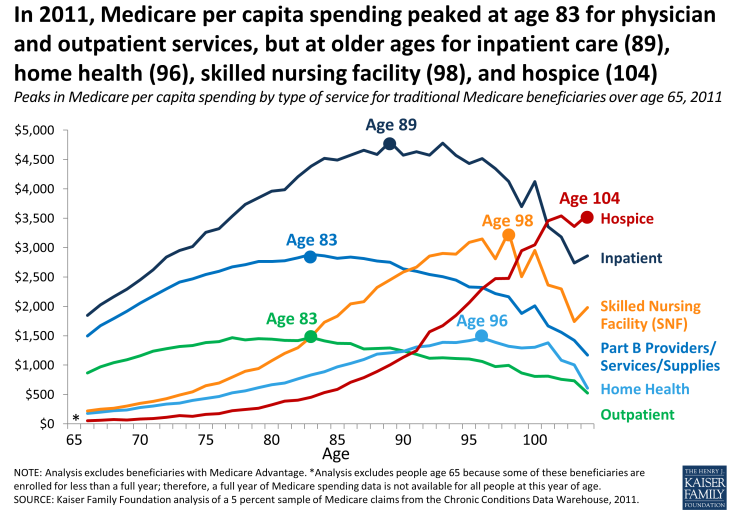

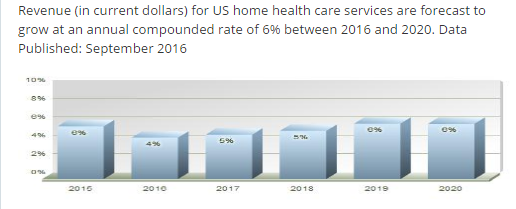

Other broader industry insights support Figure 5 below. According to a recent non-profit report, health spending growth in the United States is projected to average 5.8 percent for 2014–24, reflecting the Affordable Care Act’s coverage expansions, faster economic growth, and aging population. The health share of US gross domestic product is projected to rise from 17.4 percent in 2013 to 19.6 percent in 2024. *Healthaffairs.org

Industry Challenges

A number of companies and individuals have been prosecuted for billing fraud and other illegal practices. As with other health care providers, home health care companies are facing greater regulatory scrutiny, especially as the aging of the US population leads to increased Medicare spending on home services. *Hoovers A recent report by the Department of Justice brought charges against 301 individuals alleging $900 in false billings. Read more.

“The Medicare Fraud Strike Force operates in nine locations and since itsinception in March 2007 has charged over 2,900 defendants who collectively have falsely billed the Medicare program for over $8.9 billion.

Including today’s enforcement actions, nearly 1,200 individuals have been charged in national takedown operations, which have involved more than $3.4 billion in fraudulent billings.” Justice.gov

Reimbursement rates that insurers allow for specific home health care services, especially Medicare, are vital to providers. Efforts to reduce national health care costs have made Medicare reimbursement a political issue. The industry already operates with low margins, so any cuts in reimbursement rates directly impact profitability. *Hoovers

St. Jude Medical recently announced results of a five-year study that found patients with cardiac devices who use remote monitoring have significantly fewer hospitalizations and lower overall healthcare costs than patients who do not use or adhere with the technology. Remote monitoring can also dramatically improve patient follow-up care and clinical outcomes for patients. *SJM.com