What Consumers REALLY Want in Snack, Coffee, Tea & Cocoa Products 2/25/2020

In the coming years, consumers are not going to become less busy, nor is the wellness trend going to disappear. This means brands and retailers need to provide snacks and beverages that fit into these consumers' on-the-go lifestyles while providing better alternatives—the keyword being better.

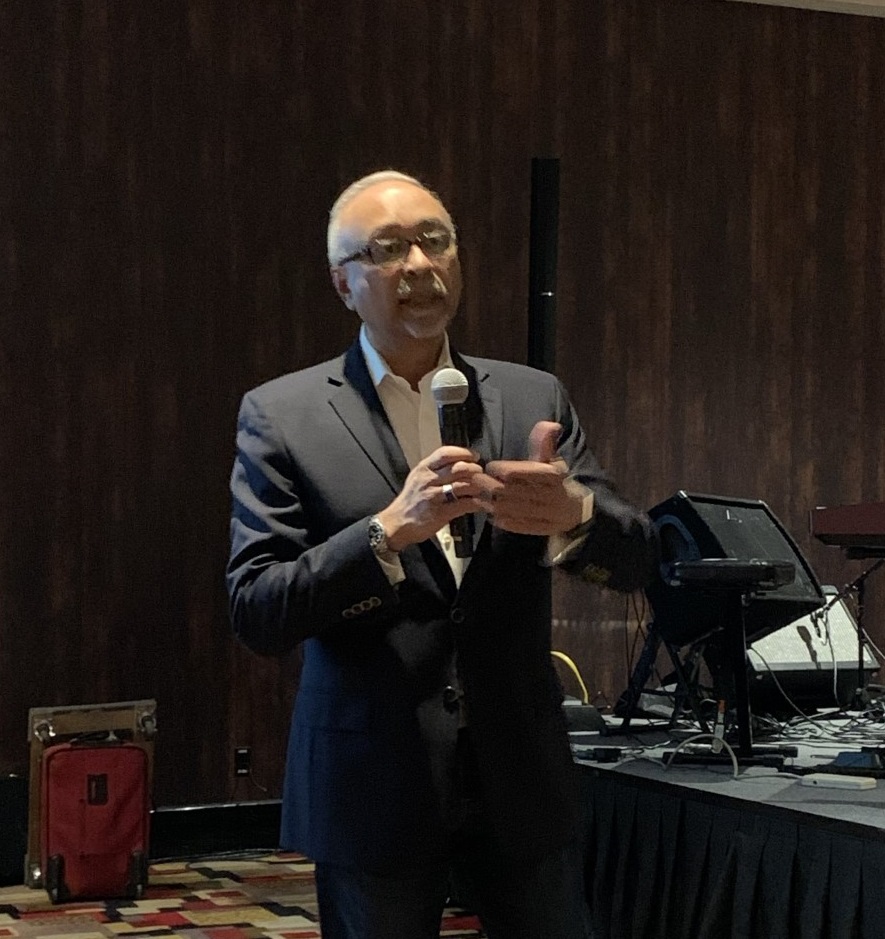

Razi Imam, Co-Founder and CEO of 113 Industries, took a deep dive into the changing behaviors of consumers in the categories of snacking and coffee/tea/cocoa during his presentation at ECRM's Center Store Week Programs based on artificial intelligence tools the company has developed that analyze social media conversations to detect those compensating behaviors and unarticulated needs that when satisfied lead to immediate adoption of a product.

Among the overall findings was that consumers are willing to accept snacks and drinks that are not perfect if they do offer a combination of: healthy alternatives, portability, high-function and a flavorful experience.

Click here for the presentation slides: 113 Industries ECRM Presentation.pdf

Click here to listen to the full presentation audio on The ECRM Podcast.

(For more information about ECRM's Center Store Week Programs, please see the links below).

7 KEY CONSUMER SEGMENTS BASED ON SNACKING BEHAVIORS

Based on the analysis of socal media conversations among consumers, people who cosumed snacks fell into one of seven categories:

1. THE DAILY SNACKER: Snacks out of habit or preference out of boredom and/or satiation

2. THE MIDNIGHT SNACKER: Motivated by spur-of -the-moment desires late at night

3. THE PARENT: Values convenience and ease of use for themselves and their children

4. THE WELLNESS SNACKER: Gravitates toward “better-for-you” ingredients and foods

5. THE TRAVEL SNACKER: Eats snacks in place of meals when onthe-go

6. THE DIETER: Seeks out the perfect snack that is compliant with specific dietary needs

7. THE SPORTS SNACKER: Views snacking as a shared experience during sporting events

Snacks have evolved to a place of holding higher responsibility than simply “food that satiates.” Originally, the role of snacks was to satiate in moments of hunger between the traditional three meals per day. Now, however, its role is to protect, maintain, and improve mental and physical health. Indeed, snacks provide fule for consumers in both the literal and figurative sense -- they provide the body and brain with nourishment and energy throughout the day, but they also provide emotional and mantal fuel to stave off hunger in a healthy way to prevent binge eating or unhealthy snacking temptations.

Snacking also allows for smaller meal portions overall, leading to the mindset of a healthier lifestyle. Many consumers are abandoning the traditional mindset that three meals per day is the standard, instead replacing with several smaller meals comprised of foods formerly viewed as snacks.

113 Industries research also found that consumers' lifestyles are driving their snacking behavior, and so snacking that fits into the lifestyles they’ve chosen will always win, such as those snacks aimed at specialty diets of Paleo, Low Carb, Weight Watchers, Whole30. Wellness snacks serve an important role in overall physical and mental wellness—snacking is viewed as a means of alleviating anxiety, depression, and eating disorders.

'Snacking that fits into the lifestyles consumers have chosen will always win, such as those snacks aimed at specialty diets of Paleo, Low Carb, Weight Watchers, and Whole30'

Once the need for healthier options is solved, consumers begin to evaluate snacks for more pleasureoriented elements like:taste, texture, aroma, visual appeal and portabilty.

Interestigly, the snack foods most frequently praised online strongly resemble foods traditionally viewed as or marketed as children’s snacktime items, such as sliced vegetables or fruits and dips, gummies, baked chips or crackers, cheese & nut/dried fruit protein packs. Because of this, buyers should think about purchasing snacks that are age-agnostic, yet sell a better-for-you message through the imagery and packaging. The mentality here is "If it is good enough for my child, then it should be good enough for me”

COFFEE, TEA & COCOA: OVER 1 MILLION DIGITAL DISCUSSIONS

Consumers certainly aren't shy about coffee, tea and cocoa when it comes to social media, and for these categories 113 Industries analyzed more than 1 million discussions online between 2015 and 2020.

The research uncovered three categories of consumer behavior when it came to coffee:

1. THE COFFEE NOVICE: Focused solely on coffee as a fuel source and flavor that they enjoyed and/or tolerated over the ritual and passion

2. THE COFFEE LEARNER: Sees coffee fuel, but also has an appreciation for the flavor and routine involved with the beverage; is exploring new brewer types for the first time

3. THE COFFEE AFICIONADO: Has a strong passion for the flavor, consistency, routine and status of a quality cup of coffee

When it comes to tea, consumers were motivated by the following factors:

1. Health benefits/hero ingredients

2. Beverage variety

3. Ease of preparation

4. Flavorful experience

5. Versatility (drinkable any time of day

6. Ability to customize

As consumers have become more health conscious, sugar is now top of mind, and many consumers are looking to limit or eliminate sugar consumption in their beverages.This creates both challenges and opportunities for the overall beverage industry, as consumers abandoning sugary beverages will need something to fill the void. They are seeking to reduce sugar via lower-sugar options, alternative sweeteners and by limiting consumption.

They accomplish this by trading high-sugar options like lattes, cappuccinos, cocoa, and sweet tea for options like black coffee or cold brew, and black, green, or chamomile tea, but also by restricting the amount of sweet beverages they drink rather than giving them up or reduce sweetness. Consumers see coffee and tea as beverages offering more freedom to directly control how much sugar or sweetener they add to meet their desired level of permissibility.

This transition away from sugar will likely spark increases in the sizes of The Coffee Learner and The Coffee Aficionado consuer segments. These segments are excited by the flavor of coffee and are less interested or not interested at all in sweetening their coffee, so they will be more satisfied with no-flavoradded coffee beverages.

Tea drinkers motivated by health benefits/hero ingredients and the ability to customize will be drawn to beverages that augment their healthy lifestyles and allow them to create their own flavorful experience with their flavor additives or sweeteners. According to the research, consumers are willing to accept “less sweet” in exchange for better health, and satisfying the sweetness craving is flexible -- consumers don’t need exactly the same amount of sweetness every time.

Buyers should think about RTD drinks that allow consumers to control their sugar consumption. Consumers want more control over the level of sugar they’re consuming in beverages (regular, variable, low-sugar, no-sugar, etc.). They should also provide them with means of enhancing taste, flavor, sensations, or experiences to coffee, tea, and other beverages without adding sugar (or in place of sugar). Finally, they should provide products that assist consumers in their efforts to wean themselves off sugar—insert your brand into the process they are already doing on their own.

It's clear that consumers are looking for more customized versions of snacks, coffee, tea and cocoa to suit their changing lifestyle needs, and by paying close attention to their unsrticulated needs via social media listening, retailers and brands will be able to not only stay on-trend in these categories, but be one step ahead of them!

Sarah Davidson is ECRM's SVP of Grocery, and can be reached at 440-542-3033